The MCPL Blog

Follow our blog for the latest library news, reading suggestions, research tips and more!

The content of our blog is also shared on our social media channels, via our e-newsletter and in our print newsletter.

“Dream Big with MCPL” Strategic Plan is Complete!

The Marathon County Public Library is pleased to announce the completion of Dream Big with MCPL, the strategic plan that will guide our efforts to serve the public over the next five years. We’ve spent the past year looking back at where we’ve been, where we are now,...

Celebrate the solar eclipse with MCPL!

Three Ways to Celebrate: All MCPL locations will be celebrating the 2024 Total Solar Eclipse! As part of a grant, MCPL has received solar eclipse glasses to give away for free at all nine locations. Prior to the eclipse date of April 8, we've planned a variety of...

YOLO @ MCPL Stratford

YOLO, a pop-culture acronym short for “You Only Live Once,” has taken on a new meaning at the Stratford Branch. YOLO, standing for YOuth Library Opportunities, is also the name of MCPL Stratford’s youth team! The group had a busy year in 2023, including helping with...

New Lactation Pod!

Breastfeeding, pumping or nursing parents seeking comfort and privacy now have a convenient option at MCPL Wausau! In January, the library installed a Mamava lactation pod. A lactation pod is a freestanding, enclosed structure that provides a private, safe, peaceful...

The Oscars of Youth Lit: YMAs 2024

If you love award shows like the Oscars, Tonys, or Emmys and also have a passion for youth literature, then the annual Youth Media Awards (YMAs) are for you! This prestigious event celebrates outstanding achievements in youth literature, from books for young children...

YA Retellings

I love a good retelling. Whether it be of folklore, a fairy tale, a classic novel, a Shakespeare play, or something else, I love the way a retelling updates a story and brings new insights for a modern audience. It’s also just fun to see a beloved story and characters...

Young Adult Library Groups Coming in 2024

Two MCPL locations will be giving youth a voice and a leadership opportunity starting in 2024. MCPL Wausau’s youth advisory committee, Young Adult Library Leaders (YALL), and the MCPL Mosinee Branch Teen Advisory Group (TAG) will offer youth in those areas a chance to...

MCPL Athens has moved!

Update: See beautiful new Athens Branch starting Nov. 13, 2023! MCPL Athens will be opening to the public at its new location on Monday, November 13 at 10:00 a.m.! A lot of work was done in the short time the branch was closed for the move. Library Director Leah...

And our Horror Story contest winners are…

It's time to announce the winners of our Two Sentence Horror Story Contest! In total, we received 36 entries across the three categories! Even more impressive is more than 200 of you voted for your favorite! Without further adieu... The Winner in the Age 7-12 category...

Cultural Threads traveling exhibit coming to MCPL

What is Cultural Threads? Celebrate and learn about the many cultures living in North Central Wisconsin by visiting the Cultural Threads: Expressing Identity through Traditional Clothing art exhibit, coming soon to MCPL! The exhibit features a collection of dolls with...

Vote in our “Two Sentence Horror Story” contest!

It’s time to vote for your favorite in MCPL’s Two Sentence Horror Story contest! The entries are divided into three age groups: 7-12, 13-18, and Adults. Click this link to view all the entries, and voters can pick one entry in each age group. Voting is open through...

Central Wisconsin Book Festival 2023

The 7th annual Central Wisconsin Book Festival is almost here! Our festival is organized and hosted by the Marathon County Public Library in Wausau, McMillan Memorial Library in Wisconsin Rapids and Portage County Public Library in Stevens Point. A committee of about...

World Kid Lit Month Reads

September is World Kid Lit Month and MCPL’s collection is bursting with books to encourage global reading. Read on for some recommendations from nearly every continent across the world!Africa Africa, Amazing Africa by Atinuke and Mouni Feddag This colorful book is a...

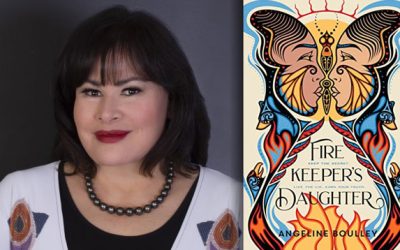

Book Festival to host Angeline Boulley

The Central Wisconsin Book Festival (CWBF) is excited to announce that Angeline Boulley—author of “Firekeeper’s Daughter” and the new release “Warrior Girl Unearthed”—will appear via Zoom on the evening of September 28 for a moderated discussion about her novels and...

Two Sentence Story Contest

Marathon County Public Library is pleased to announce the winners of the 2 Sentence Story Contest held this spring. The winning stories were chosen by popular vote during the first week of May, and they’ve been given illustrations by MCPL staff!The winning story in...

Check Out Wisconsin State Parks at Your Library!

UPDATE: As of July 18, 2023, all available passes have been checked out. Thank you to our partners, and all patrons who participated! Planning a trip to a Wisconsin state park or forest this year? The library can help! The Wisconsin Department of Natural Resources...

Historic maps added to digitization project!

New historical content has been added to the Central Wisconsin Digitization Project, including historic plat books! These historic plat books are from approximately 1882, 1895 and 1901. In addition, there is a book created by the Marathon County Highway Department...

Request for Proposals: Strategic Plan & Mission Statement

Marathon County Public Library (MCPL) invites consultant proposals to facilitate and coordinate the development of MCPL’s first strategic plan and review the library’s mission statement. MCPL desires a citizen involved process that results in an actionable plan with...

Wi-Fi hotspots now available for checkout!

The Marathon County Public Library (MCPL) is pleased to announce the start of a new Wi-Fi hotspot lending pilot program at all nine of its locations! Effective immediately (February 2023), two Wi-Fi hotspots are available for checkout at each MCPL location. These...

A Book and a Podcast: The Perfect Pairings

When you finish a book, librarians often have recommendations for what to read next. I’m going to take a slightly different approach and recommend several podcasts based on books that I have enjoyed. These programs aren’t all strictly podcasts. Some broadcasters, such...

Youth Media Award Winners Announced!

The Caldecott and Newbery award winners were announced by the American Library Association on Monday, January 30 as part of the annual Youth Media Awards. Prior to the announcement of the winners, Youth Services staff from MCPL Wausau predicted which books they...

MCPL predicts the 2023 Caldecott and Newbery winners!

Each year, the Randolph Caldecott Medal is awarded to the most distinguished American picture book for children, and the John Newbery Medal is awarded to the most distinguished contribution to American literature for children. MCPL Youth Services staff members chose...

Switch to the Libby app soon!

If you use the OverDrive app to access Wisconsin’s Digital Library for free e-books, e-magazines and audiobooks, please plan to switch to the Libby app by the end of April 2023.

Website is undergoing maintenance

The MCPL website (mcpl.us) currently is undergoing maintenance. More MCPL content will be brought online as soon as possible. We are sorry for the inconvenience. Marathon County Public Library (MCPL) Phone: 715-261-7200 Fax: 715-261-7204 Email: info@mcpl.us 24/7...